The Authors

Introduction

“…Australia (and Victoria in particular) has massive wind generation capacity…”

The Victorian labour party engaged with renewables as a cornerstone of its election campaign, ambitiously setting a 95% renewable energy target by 2035 and promising $1 billion to renewable energy projects run by the State Energy Commission. The Victorian liberal party picked up on the shift too, promising more solar panels and batteries for households, along with a $1 billion clean hydrogen strategy. Labour won, so the 95% gauntlet had been thrown down. Jonathan La Nauze, the CEO of Environment Victoria described these election promises as “a race to the top” for the environment. Offshore wind is about to enter that race, and its being given a head start in Victoria.

A Pipeline for the Offshore Wind Sector

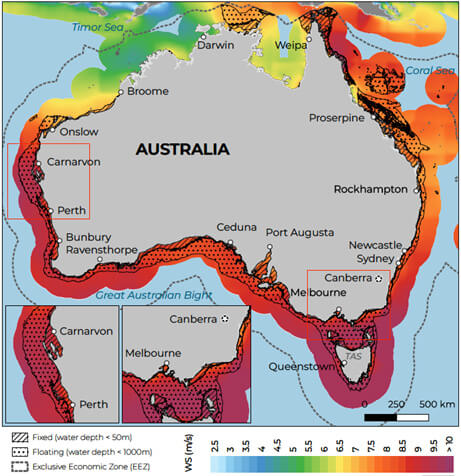

Australia’s offshore wind capacity is noticeably underutilised. According to the Victorian government’s Offshore Wind Policy Directions Paper, the Victorian coastline along Gippsland and Portland has the potential to support 13 gigawatts of capacity using fixed platforms in shallow waters.[3] That’s more than 5 times the current renewable energy generation in Victoria. Harnessing strong and consistent winds off that coastline is critical but there is a lot of work to do before that can be captured.

In June 2022, the Commonwealth government formalised its plans for the Gippsland Coastline, declaring it Australia’s first offshore wind zone when it passed the Offshore Electricity Infrastructure Act 2021 (the “Act”). The Act named other areas of interest in Western Australia and New South Wales. Under the Act, the Minister for Industry, Science, Energy and Resources can issue a variety of licenses, including feasibility, commercial, transmission and infrastructure and research licenses, to facilitate the development of offshore assets.

On the heels of passing the Act into law, the Victorian government released its Offshore Wind Implementation Statement (the “Implementation Statement”) – effectively mapping out a plan to get offshore wind up and running. The Implementation Statement focusses on early-stage uptake of Victoria’s offshore wind goals through transmission network and port upgrades, as well as establishing a regulatory framework to kickstart the offshore wind sector.

“…significant investment is required to upgrade Australia’s grid capacity to handle the increase in electricity required to power homes and businesses.”

Transitioning away from coal-fired power is a key step to reach Australia’s net zero target, but significant investment is required to upgrade Australia’s grid capacity to handle the increase in electricity required to power homes and businesses. Without power generated from fossil fuels, the Australian Energy Market Operator (AEMO) estimates that the National Energy Market will need to double its electricity generation from renewables by 2050. That is a significant increase of electricity into Australia’s existing grid network and coordination between Australia’s national plans, and Victoria’s state-based goals is essential.

The AEMO’s Integrated System Plan proposes to improve grid capacity by adapting existing networks for two-way electricity flow and installing more than 10,000km of new transmission lines to connect renewable assets into the grid. Future work includes Victorian projects within the designated renewable energy zones. This represents vast investment in new infrastructure, concerningly during a worldwide crisis in supply chains and labour – a risk insurers should bear in mind.

In Victoria, VicGrid will lead the development of transmission infrastructure to ensure renewable energy generated offshore can be plugged into Victoria’s electricity grid through underground cables fed into onshore connection points. Aspiring to generate first power from offshore wind by 2028, there is little room for delay. But grand ambition carries with it significant risks and challenges, and Australia has the experience of others to learn from.

The UK Experience

Renewable energy generated from wind is a stalwart of the United Kingdom’s energy generation, second only to natural gas. The Hornsea 2 windfarm, recently commissioned off the Yorkshire coast, is the largest in the world and unsurprisingly, the United Kingdom (UK) keeps setting records in the renewable space. On 2 November 2022, the UK achieved a milestone in wind generation by producing 20,896 megawatts of energy in a 30-minute window. To put that in perspective, 20,896 MW is 53% of the UK’s electricity. Put simply, the UK is no newcomer to offshore wind generation.

The UK plans to increase offshore wind capacity from 11 GW in 2021 to 50 GW by 2030, requiring huge investment in onshore and offshore infrastructure in England, Wales and Scotland. Yet, to meet its net zero target it must install 75 GW by 2050. Aside from the ever-present issue of how this volume of capacity is to be installed, there is an equally pressing challenge – that of connection. This is also true for Australia.

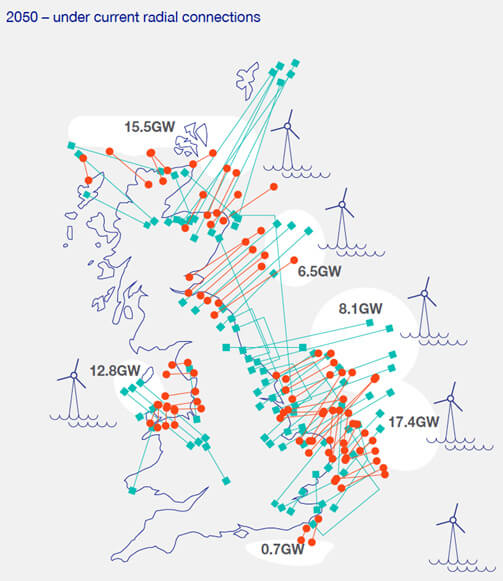

Currently, each new offshore wind development designs and builds its own Onshore Sub-Station (OnSS) that facilitates connection to the grid. Each new development installed creates a new link to shore that radiates out from the grid as the focal point. This is known as a radial grid development and has been the connection strategy deployed by the UK to date.

Considering the planned growth of the UK offshore wind industry, development constraints caused by the grid’s inability to accept projected capacity are to be expected. Figure 2 below is a projection from National Grid of the complex and clustered nature of this strategy. Compare the High Voltage Alternating Current (HVAC) cables, shown in red, linking near shore applications and High Voltage Direct Current (HVDC) cables, shown in teal, for longer transportation solutions. The HVDC cabling method decreased inefficiencies while allowing deeper penetration of wind resources.

The UK’s “Grid of the Future”

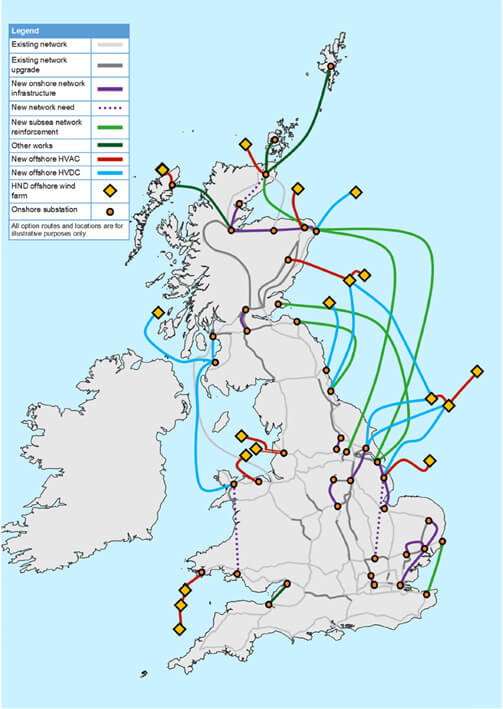

By contrast, the grid of the future is interconnected, both within itself and to other national grids. This reduces the number of land fall sites, facilitates cost sharing across developments and allows for transmission up and down the respective coastal areas delivering power respective to demand. Integration of the supply from offshore farms allows for a simplified solution as depicted in Figure 3. In addition to the fewer OnSS, the use of HVAC connections is considerably reduced, and offshore interconnector stations are introduced.

Interconnections, nationally and internationally, will be vital going forward to link offshore hubs and different national networks allowing power sharing and load normalisation. Nearly 8GW of interconnectivity is to be in place for the UK by 2024, giving power security for up to 8.5 million homes.[5]

In their most recent study, Pathway to 2030 – Holistic Network Design,[7] the National Grid Electricity System Operator (ESO) has considered the above scenarios and proposed a solution for a connected future. This Holistic Network Development (HND) plan to 2030, envisages a solution where local radial solutions are applied, but more broadly, an integrated solution is proposed.

A key element of the integration is utilising longer HVDC connections in offshore corridors, reducing cables to shore by a third and minimising network constraints, the need for future infrastructure, and seabed impact.

However, this all comes at significant cost. The offshore investment required, in grid infrastructure alone, is estimated at £7.6 billion to realise £13.1 billion savings in constraint costs.[8] The future proofing of this investment achieves a net saving to consumers of £5.5 billion, but importantly allows for the accelerating expansion predicted through to 2050.

The recommended design from National Grid ESO is summarised in Figure 4 below, showing both the major offshore and onshore developments required.

“National Grid ESO estimate that some 94 reinforcement projects are needed at a cost of £21.7 billion to meet the British Energy Security Strategy by 2030.”

This, however, is not the complete picture. The grid needs significant strengthening and redesign onshore to transport the power to the end users. Despite the UK’s significant and advanced National Grid, it is currently structured to supply power outward from central locations. Shifting to a system where power generation is on the periphery requires transportation in the opposing direction. National Grid ESO estimate that some 94 reinforcement projects are needed at a cost of £21.7 billion to meet the British Energy Security Strategy by 2030.[10]

Both the offshore and onshore solutions require the utilisation of larger HVDC cables and corresponding HVDC technology. This represents a significant growth away from the current use of HVAC cabling for HV power transmission.

“…the grid of the future is interconnected, both within itself and to other national grids.”

In short, the grid of the future places an emphasis on longer transmission distances and consequently the development and supply of HVDC cabling and equipment. The challenge is to avoid the risk of ‘tipping point’ distances where AC transmission losses outweigh the additional cost of HVDC transmission equipment.

Lessons for Australia?

Australia’s (and various States’) ambitious emission targets require significant offshore wind development in a relatively short period of time. Like the UK, Australia’s renewable energy sources are dispersed across both land and sea. Accelerated transition to a fully renewable grid demands not only consideration of immediate logistical problems but also those which may arise when Australia’s demand for renewable resources inevitably increases.

Short term investment and development may deliver short term solutions. But there is an opportunity to look to the UK’s plan and consider whether a similar HND model could avoid longtail logistical problems as Australia’s capacity expands. Australia must be alive to the UK experience, where increased demand for renewables required more offshore assets, both shallow and deep water, and led to radial grid development with a clustered and inefficient network that must now be redeveloped.

Australia faces significant challenges in meeting its renewable targets, least of all, upscaling our national grid at break-neck speed. Key to achieving these outcomes will be the development of infrastructure based on careful planning strategies and smart technology. As Danielle Jarski from RWE Offshore Wind puts it: “…the challenges come not only from innovation in the ocean but also good planning on land.” [11] In short, the two must be connected, and evolve in tandem.

Logically, a grid that favours long transmission distances is an idea apt for Australia. The HND model will require investment in not just attracting local content for technology manufacturing and installation expertise, having the regulatory framework to expedite the approval process, but importantly having a transmission grid fit for the future. A one-size fits all approach does not exist, but one thing can be said for sure – as demand for renewable energy increases, so will our appetite for developing more complex, long-distance assets.

Takeaways for Insurers in Australia

Insurers will no doubt be alive to the considerable underwriting opportunity from Australia’s offshore wind ambitions. Development of these platforms requires enormous investment in transmission networks, port upgrades, construction of infrastructure, new technology and operational care. Undeniably, there is a lot of risk to defray.

With this type of risk traditionally being placed in overseas markets, Australia’s underwriting experience for offshore wind projects is in its infancy. At this early stage of the transition, construction risks relevant to grid and port upgrades will enter the market. This is not altogether new ground for Australian insurers. However, the construction phase of the planned offshore wind assets, marine cover for specialist vessels necessary for the offshore construction and operational cover presents a healthy pipeline of premium for Australian insurers, albeit in unfamiliar territory.

Underwriters would be wise to consider the markets where offshore wind is already a cornerstone of renewable energy generation in preparation for the increasing number of offshore wind projects. The UK’s experience with wind generation technology, highly advanced equipment (such as HVDC cabling and rectification equipment), supply chain issues and governance risk can inform locally based insurers’ risk approach with tailored wordings that have been tested abroad.

Lessons from countries that have weathered the risks and benefits from offshore wind generation are invaluable, and in a sense, can serve as an alternative “road map” to risk and reward.

[1] GWEC Technical Offshore Wind Potential, Australia, published June 2021.

[2] GWEC Technical Offshore Wind Potential, Australia, published June 2021.

[3] Note shallow water in this context typically implies up to 60m Water Depth (WD)

[4] A Connected Future, National Grid, p. 10, April 2022.

[5] A Connected Future, National Grid, p. 4, April 2022.

[6] A Connected Future, National Grid, p. 10, April 2022.

[7] Pathway to 2030: Holistic Network Design, National Grid, July 2022

[8] Pathway to 2030: Holistic Network Design, National Grid, p. 7, July 2022

[9] Pathway to 2030: Holistic Network Design, National Grid, p. 33, July 2022.

[10] Pathway to 2030: Holistic Network Design, National Grid, p. 7, July 2022.

[11] Danielle Jarski, Chief Development Officer at RWE, LinkedIn post, Danielle-Jarski_wind-solar-power-activity